2024 and The UK's Vibrant Early-Stage Investment Landscape

The early-stage investment ecosystem in the UK has long been a beacon of possibility for entrepreneurs and angel investors alike. As we delve into 2024 so far, it's useful to reflect on how this landscape has evolved over the last eighteen months, and what trends and opportunities might unfold throughout the remainder of the year.

Angel investors play a pivotal role in the ecosystem, not only providing capital, but critical value through mentorship and strategic guidance to fledgling start-ups. These reflections consider the current state of early-stage investments, how it contrasts with the scenario in 2023, and the developments that may shape the rest of 2024.

The Current State of Early-Stage Investments in 2024

With an uptick in activity and diversification, 2024 has seen a marked increase in early-stage investment across sectors. The rebound from the pandemic-induced slowdown has gained full momentum, with more discerning angel investors now returning to the market. The array of industries attracting investment has broadened, moving beyond traditional technology and fintech domains to encompass health tech, climate tech, and creative industries.

The UK government’s support of the early-stage investment ecosystem persists through the continuation of various incentives. The Enterprise Investment Scheme (EIS) and Seed Enterprise Investment Scheme (SEIS) remain cornerstones, providing tax reliefs that make early-stage investments more attractive. Enhancements to these schemes have been introduced throughout 2024, such as higher investment caps and broader eligibility criteria, encouraging and enabling more angel investors to participate.

London has traditionally been the epicentre of early-stage investments in the UK. However, 2024 has witnessed a significant rise in regional investment hubs outside of the Golden Triangle. Cities such as Manchester, Edinburgh, and Bristol are emerging as vibrant centres for start-up activity, driven by local government initiatives and regional investment funds. This decentralisation is creating a more balanced and diverse ecosystem across the UK.

A Year of Change: 2023 vs 2024

In 2023, the early-stage investment ecosystem was still grappling with the aftershocks of the COVID-19 pandemic. Although there were signs of recovery, investor confidence was tentative when looking at new opportunities, with many preferring to double down on current portfolios. The volume of investments in 2023 was modest compared to pre-pandemic levels. Fast-forward to 2024, however, and the UK landscape has transformed considerably, experiencing a dynamic and promising phase; Renewed investor confidence is building and we are beginning to see increased deal flow and higher valuations for start-ups.

Compared to 2023, there is a noticeable increase in investment activity, sector diversification, and a shift towards more aggressive funding strategies. The remainder of the year is poised to bring further growth, driven by technological advancements, supportive regulatory changes, and the rise of regional investment hubs.

For angel investors, this landscape offers a wealth of opportunities. Embracing impact investing, staying informed about emerging technologies, adopting collaborative investment models, and focusing on diversity and inclusion can enhance both financial returns and social impact. As the ecosystem continues to evolve, those who remain agile and informed will be best positioned to capitalise on the vibrant opportunities that lie ahead in the UK’s early-stage investment landscape.

2023 saw a surge in investments in sectors responding directly to the pandemic, such as health tech and remote work solutions. While these sectors continue to attract interest in 2024, there is a noticeable shift towards sustainability and climate tech. Investors seem to be beginning to prioritise start-ups that address environmental challenges, aligning with global trends towards climate action and sustainable development.

Many start-ups adopted cautious funding strategies throughout 2023, often raising smaller rounds to extend their runway in uncertain times. In contrast, 2024 has seen a return to more aggressive funding rounds. Founders are now more ambitious, leveraging the increased investor appetite to secure larger investments that can fuel rapid growth and scale their operations.

What’s in Store for the Rest of this Year…

We hope to see continued upwards momentum in early-stage investment growth throughout the remaining months of 2024. With the UK’s pro-innovation policies in place, the ecosystem is well-positioned for sustained growth; Angel investors should be prepared for a more competitive landscape, with high-quality start-ups attracting significant interest.

The UK government has shown a commitment to fostering innovation, and further regulatory enhancements can be anticipated. These might include additional tax incentives, streamlined processes for cross-border investments, and measures to facilitate easier exits for investors. Staying informed about these changes will be crucial for early-stage investors to maximise their benefits.

We will likely see further technological advancements and shifts in sectoral focus, with quantum computing, biotech, and space tech as areas to watch. Additionally, the integration of AI across almost all industries will continue to create disruptive opportunities, and an eye on these trends may help identify the next wave of high-growth start-ups.

Local governments and development agencies are expected to continue investing in infrastructure, education, support programs, and accelerators, strengthening regional start-up ecosystems and providing further industry traction across the UK. These burgeoning hubs working to nurture start-up growth and innovation outside of London may provide ample opportunity for angel investors, where valuations might be more attractive, and competition less intense.

Key Trends and Opportunities for Angel Investors in 2024

Unsurprisingly, impact investing has gained significant traction in 2024 with Angels increasingly looking for opportunities that deliver social value and environmental benefits alongside financial returns. This trend is particularly evident in sectors such as renewable energy, sustainable agriculture, and social enterprises, and presents an opportunity to align portfolios with personal values while tapping into growing markets.

The rapid adoption of emerging technologies is creating exciting opportunities. Artificial intelligence, blockchain, and quantum computing are areas in which UK start-ups show great promise, right at the forefront of innovation.

In 2024, more syndicates and angel networks enable investors to pool resources and share risks, making it easier for retail investors to participate in larger funding rounds. This collaborative approach also brings together diverse expertise, enhancing the support available to start-ups as well as the diversification of investor portfolios both within the UK, and further afield.

Finally, diversity and inclusion are rightly gaining increased prominence with investors recognising the value of diverse founding teams and the unique perspectives they bring. In 2024, there is a concerted effort to support underrepresented founders, with numerous initiatives and funds dedicated to promoting diversity in entrepreneurship.

- This article is not investment advice and should not be used to make investment decisions. It is a personal reflection of 18 months in the early-stage investment ecosystem, and what may come to pass in the remainder of 2024.

Authors

Related Posts

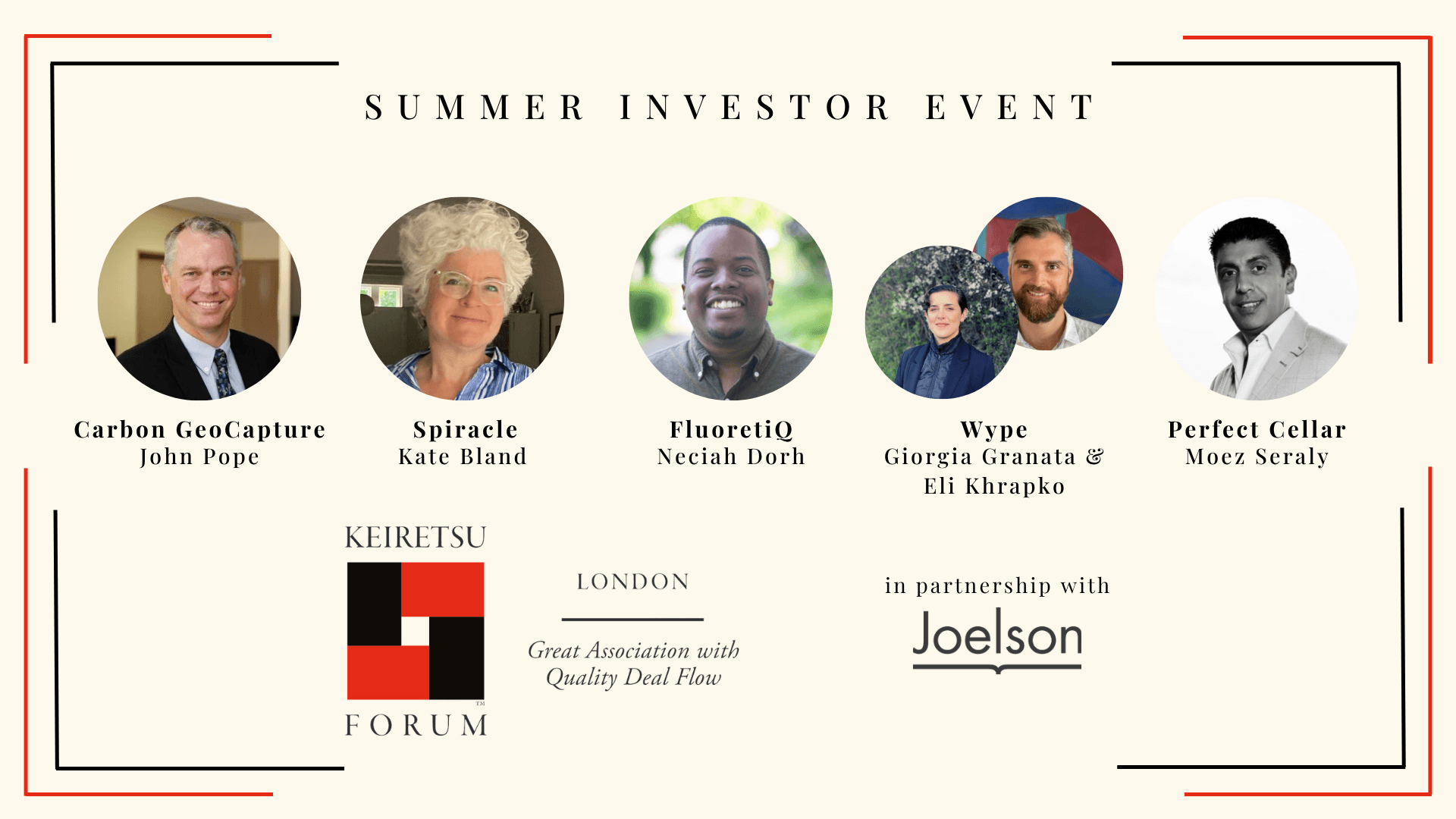

Summer Investor Event: Five Innovative Startups Take the Stage