UK Early-Stage Investment in H1 2025: Strategic Strength & New Horizons

The first half of 2025 paints a cautiously optimistic picture for early-stage investment in the UK. While headline figures might suggest a slowdown compared to the same period in 2024, what we’re really seeing is a strategic recalibration. Investors are more targeted, founders more prepared, and the market itself is shifting toward high-conviction, quality-led decision-making. This doesn’t reflect a lack of appetite for early-stage investment, in fact, it suggests a maturing ecosystem where capital is being deployed with sharper focus and longer-term vision.

For angel networks like Keiretsu Forum London, this moment presents both a challenge and an opportunity. The challenge lies in supporting our portfolio companies to sharpen their stories, traction, and investor readiness. But the opportunity is significant, because when capital is more discerning, the value of a trusted, curated investment network becomes more powerful than ever. We are not just connecting capital with companies; we’re providing vital context, filtering high-quality opportunities, and enabling intelligent, aligned introductions.

Deal Volume & Investment Value

Beauhurst’s State of UK Investment report shows that Q1 2025 saw approximately £3.8 billion in equity funding, a drop from Q1 2024’s £5.8 billion, but still very much within a healthy range for the UK early-stage market (Beauhurst, 2025). It’s worth noting that the number of deals remains strong, with over 850 completed in Q1 alone. This tells us that investors are still very active, but are choosing their commitments carefully, prioritising clarity, commercial traction, and sector alignment.

Venture-stage rounds in particular remain robust, with £1.6 billion invested across 392 rounds, suggesting that companies which have successfully moved beyond seed are well-placed to attract follow-on capital. For angel investors, this underlines the importance of early participation in companies with strong growth fundamentals, especially where later-stage capital remains readily available.

UK’s Regional Investment Evolution

London retained its position as the UK's investment powerhouse, securing around 48 % of all deals and 62 % of total funding in Q1 2025 (Crowdfund Insider, 2025). However, regional ecosystems continued to build strength and visibility.

- Scotland posted a 108 % increase in investment value to £211 million across 99 deals, even as deal count dipped slightly - demonstrating deepening investor interest.

- The West Midlands, Yorkshire, Northern Ireland and Wales also saw rises in deal volume and funding.

This demonstrates a broader ecosystem building depth and diversity beyond London.

Sector Momentum & 2024 Comparison

Tech-focused areas continue to lead: AI, SaaS, fintech, cleantech, regtech, and digital security dominated Q1 activity. AI funding hit a record £1.59 billion, a 28 % increase from Q4 2024. Similarly, SaaS deals rose 7 %, with funding soaring 41 % to £1.68 billion.

Compared with H1 2024, H1 2025 reflects a more purposeful investment approach. While 2024 marked the beginning of a rebound from 2023’s slowdown, 2025 centres on quality over quantity, supporting fewer, stronger deals with greater potential.

A Confidence-Building Outlook

For investors: Smaller but swifter seed-round investments now offer meaningful roles in early-stage companies, while venture-stage opportunities continue to deliver value through scale.

For founders: This is an excellent moment to shine, especially in tech-forward sectors, by demonstrating traction and strategic fit. Keen investor interest remains where founders clearly deliver.

For regional entrepreneurs: The increase in funding outside London is a signal, your exceptional ideas and teams are gaining national and regional traction.

Looking Ahead: H2 2025 and Beyond

UK early-stage investment in H1 2025 marks a shift to strategic, data-driven funding. Investor confidence is supported by strong sectors and regional dynamism. As we head into the second half of the year, the opportunity for angel groups like Keiretsu Forum is clear: offer capital, counsel, and connections to help stellar founders bridge the seed-to-scale journey.

Our network is committed to enabling founders with market insights, domain expertise, and global introductions, ensuring that capital meets conviction. Together, we’re building a dynamic, impactful ecosystem that adapts and thrives, no matter the macro landscape.

For further reading, check out the references and sources below!

- Beauhurst, State of UK Investment Q1 2025 itpro.com+15beauhurst.com+15Crowdfund Insider+15

- Beauhurst, The State of Investment in Scotland scottishfinancialreview.com+2beauhurst.com+2dailybusinessgroup.co.uk+2

- Crowdfund Insider, UK equity resilience amid headwinds Crowdfund Insider

- Barclays Eagle Labs & Beauhurst, Regional Investment Map Barclays Home

Authors

Related Posts

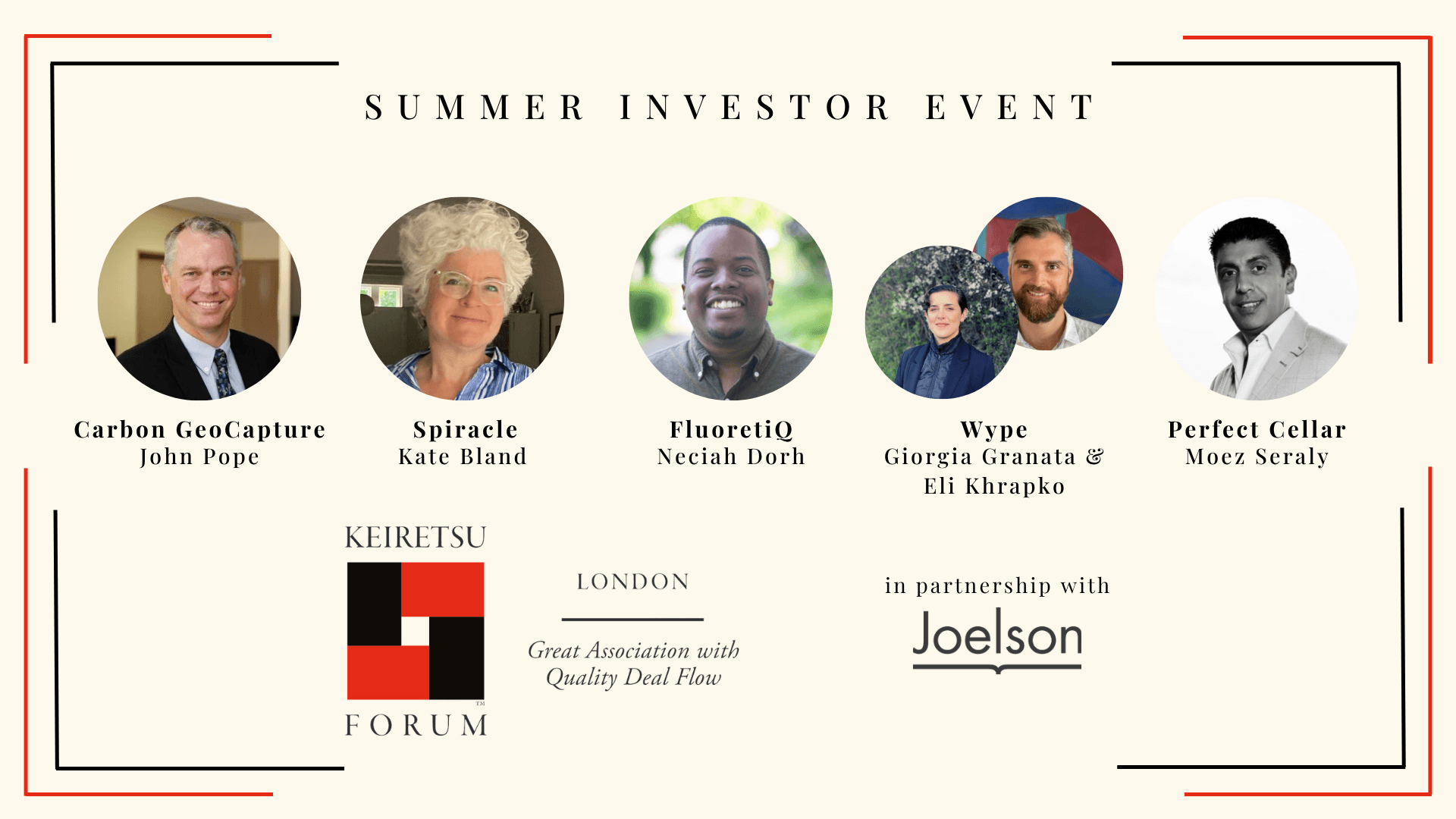

Summer Investor Event: Five Innovative Startups Take the Stage