What makes the Precision Medicine industry so exciting, and why there is so much need for Angel investors to make a difference

Buongiorno!

I am Alessandro Riccombeni, CEO and founder of Archgenomics and member of Keiretsu Forum London.

Below is some insight into what makes the Precision Medicine industry so exciting, and why there is so much need for Angel investors to make a difference.

In this short overview we’ll touch upon three topics:

- what is Precision Medicine in reality

- what kind of businesses you can expect to find

- why Angel investment is needed to capture this opportunity

What is Precision Medicine, anyway?

Precision Medicine is shifting Healthcare’s focus from the “average patient” to the individual, leading to the creation of personalised, more effective drugs, treatments and nutrition plans, all based on a patient’s specific profile.

What goes into this profile? The answer is simple: data, data and more data. In fact, even if you are not familiar with the Healthcare and Life Sciences industries, you have probably seen a few headlines like “data is the new oil”. And if you follow Technology news, you probably heard a million times expressions like “Big Data”, together with the opportunities arising from Deep Learning, Artificial Intelligence and other popular topics.

From this perspective, the foundation of Precision Medicine can be described as “Big Clinical Data”. The development of personalised drugs, treatments and predictive models depends on the availability of different, complex, sensitive data types. Your Electronic Health Record (EHR) - the information a clinic hosts on its systems about you - is the most basic information, and goes together with your imaging data (X-rays, magnetic resonances, etc.).

EHR and imaging data, however, are not enough. To get the level of precision required for Personalised Medicine, molecular information is needed: first and foremost, our genetic profile.

Many of you might remember the clamour around the publication of the first version of the Human Genome, over 20 years ago. Since then, our ability to access our DNA information, our biological blueprint, has grown exponentially. In a couple of decades the cost of sequencing a patient’s genome has dropped from three billion dollars to just a few hundreds - and economies of scale mean that eventually we’ll get under $100 per genome.

Today, more than 90% of “omics” data comes from a company called Illumina, with a market capitalization of $30 B.

With thousands of sequencers available, today it’s possible to sequence millions of individuals per year, resulting in a huge amount of data: you can estimate around 150 Gigabytes of storage required for a patient’s genome. If your laptop had 512 GB of storage available, that might be barely enough for three genomes!

This is why Precision Medicine, at its core, is Big Clinical Data: the sensitivity and footprint of the data required are unprecedented. I go into more detail into this in a keynote I gave last year for Wired Health ( https://www.youtube.com/watch?app=desktop&v=tlYxuRmLum4 ).

Note that “Omics” technology is an umbrella term which includes other molecular assays, beyond the human genome. To give you an idea about Life Sciences, the UK is home to over 400 biotech companies, around one third of all EMEA ones. Over 150 of these UK companies rely on “Omics” technology for their R&D and manufacturing.

Omics has become the basis for new IP generation: how this potential turns into revenue, though, is a different challenge.

What kind of businesses can I expect to find in the Precision Medicine industry?

You could simplify the $100 B Precision Medicine market with three areas of development:

- more accurate diagnostics tests, “Precision Diagnostics”;

- personalised drugs, treatments and nutrition plans, “Precision Therapies”;

- accurate, sensitive risk models to predict the onset of specific diseases, “Predictive Medicine”.

The reality is that the industry is still far younger than most operators realise: when we look at these free pillars - Diagnostics, Personalised Therapies, Predictive Models - very often Diagnostics dominates market efforts, and revenue outcomes.

It takes years - decades - to complete the development of a new drug, and the validation of predictive models requires longitudinal studies which follow patients since an early age. While many efforts are being made in this regard, our ability to generate the required observations is still in its infancy, and it’s not trivial to access quality, useful, usable patient data.

So, a promising startup in Predictive Medicine might eventually use the accumulated patient data and the tools they developed to pivot into diagnostics:

- “we can’t accurately predict your specific risk of developing Alzheimer in later age…”

- “… but, based on your profile, we expect this drug to have a 20% higher efficacy for you”

You probably read the news about the antitrust block Illumina’s acquisition of Grail, a diagnostics company. Now you should start to understand the reasons: a global monopolist in data creation sought to gain an advantage in the only profitable downstream segment, Diagnostics.

Note that the infrastructure challenges we mention bring a fourth group, 4. “Population scale clinical infrastructure” (which is the focus area of Archgenomics itself).

Why is Angel Investment so badly needed?

The promise of Precision Medicine, “to prevent illness before it happens” is currently tied to a $100 B global market, destined to grow in line with the adoption of Omics technology: to give you an idea, today we only have enough sequencers for less than 10 million patients per year. Despite the size, Precision Medicine is still in its infancy.

All the focus areas - Diagnostics, Personalised Therapies, Predictive Medicine, Infrastructure - have one thing in common: the need for millions of dollars in seed stage investment.

It all starts with the requirement to access and manage clinical data. Biomedical research and the management of clinical data require specialist expertise, laboratory space and clinically compliant systems, from the beginning. Without the right level of resources, access to sensitive data can truly be a challenge. Sometimes this can be offset by ceding equity to a “Data Controller”, e.g. a clinic; however, this brings the risk of losing equity and control in exchange for little more than data access, still without accessing the capital needed.

With more attention from Angel Investors, the infant $100 B Precision Medicine market could find its feet and accelerate further, bringing together specialist resources and R&D assets to generate new IPs much faster than today. The UK is effectively the World Capital of Genomics: the structure of the DNA molecule was announced here in Cambridge, and Illumina’s technology was first created by Solexa, a British biotech.

The UK has an unprecedented concentration of talent, ambition and resources for Precision Medicine to thrive - but way too much of this potential is withered by the impossibility of moving the first steps with clinical data.

Back then, in the Silicon Valley, me and my colleagues often talked about “making the world a better place”: the concrete opportunity is here, close to home. Sometimes an Angel is needed to show the world a new perspective.

In conclusion

I hope you found this introduction interesting. I am aware it might be a lot of new information for many of you: I’ll be happy to follow up in person at our September meeting, or at the first occasion.

Yours,

Alessandro Riccombeni MBA, Ph. D.

Biography

Dr. Alessandro Riccombeni is the CEO and founder of Archgenomics, a new startup at the intersection between public healthcare and drug discovery. He has more than 15 years of international experience in biomedical research, product development, and market strategy. Before creating Archgenomics, Alessandro served as Microsoft’s first executive for genomic medicine, as National Genomics Officer for the UK. Prior to that, Alessandro led the development of Amazon Web Services’s international Precision Medicine business, enabling the creation of Amazon Omics, Big Tech’s first managed service for Precision Medicine.

Alessandro started his career in research, in Oncology and Infection Biology, before moving into industry. Dr. Riccombeni holds a Ph. D. in Computational Infection Biology from University College Dublin and an MBA from London Business School.

Authors

Related Posts

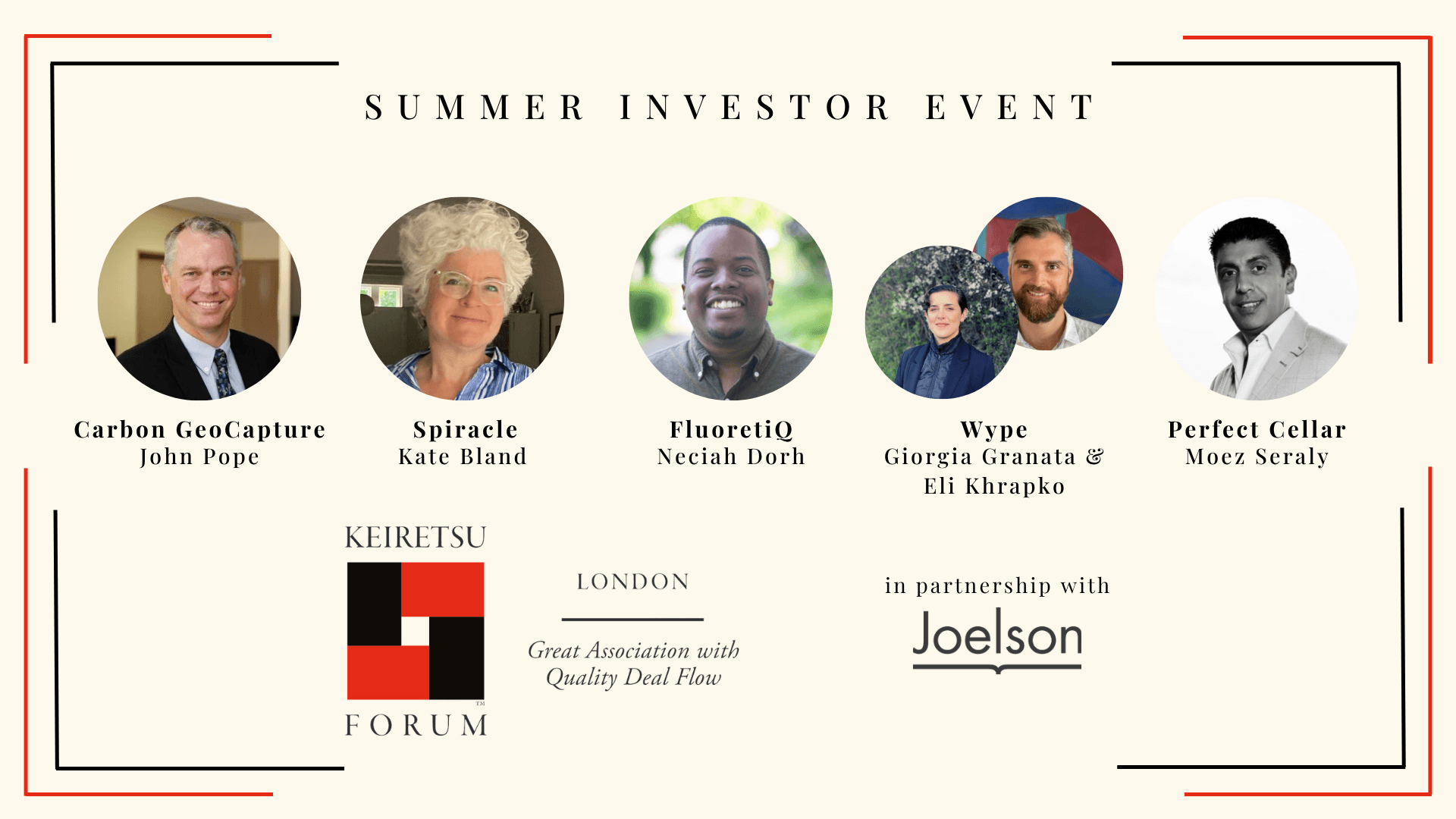

Summer Investor Event: Five Innovative Startups Take the Stage